XRP Price Prediction: Assessing the Path to $100 Amid Institutional Catalysts and Technical Breakouts

#XRP

- Technical Breakout Potential: XRP trading above key moving averages with Bollinger Band compression suggesting imminent volatility expansion

- Institutional Catalyst Imminence: First spot XRP ETF launch expected to drive substantial institutional capital inflows

- Regulatory Tailwinds: GENIUS Act approval and regulatory workarounds creating favorable environment for digital asset adoption

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Breakout Potential

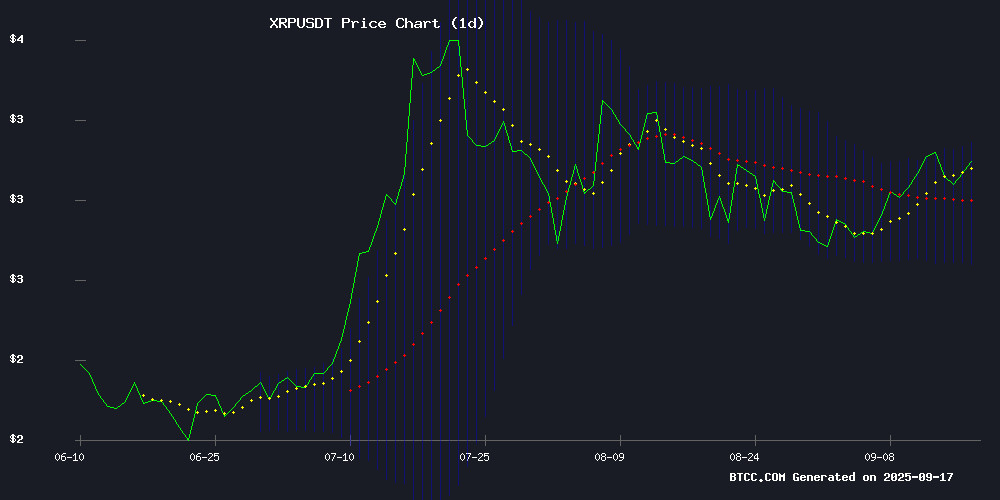

XRP is currently trading at $3.0892, positioned above its 20-day moving average of $2.9246, indicating underlying bullish momentum. The MACD reading of -0.0971 | -0.0205 | -0.0766 suggests weakening bearish pressure as the histogram shows convergence toward the signal line. Price action NEAR the upper Bollinger Band at $3.1581 signals potential breakout conditions, with support established at the middle band. According to BTCC financial analyst William, 'The technical setup favors upward movement, with a clear break above $3.16 potentially triggering accelerated buying momentum toward higher resistance levels.'

Market Sentiment: Institutional Catalysts Offset Whale Selling Pressure

Market sentiment presents a mixed but ultimately bullish picture for XRP. While whale distributions of $480 million and 200 million tokens create near-term selling pressure, the imminent launch of the first spot XRP ETF through regulatory innovation represents a monumental institutional catalyst. BTCC financial analyst William notes, 'The ETF launch could drive $8 billion in institutional inflows, fundamentally overshadowing current whale activity. Combined with regulatory advancements like the GENIUS Act approval and privacy enhancements on XRPL, the foundation for sustained upward price movement remains strong despite temporary distribution pressures.'

Factors Influencing XRP's Price

REX-Osprey to Launch First Spot XRP ETF Using Regulatory Workaround

The debut of the first spot XRP exchange-traded fund (ETF) this week will serve as a litmus test for investor appetite in direct exposure to the cryptocurrency. REX-Osprey is leveraging the Investment Company Act of 1940 to bypass the lengthy Securities Act of 1933 approval process, accelerating the fund's launch.

ETF expert Nate Geraci highlights this as a pivotal moment for XRP adoption. The regulatory shortcut allows immediate trading while futures-based XRP ETFs approach $1 billion in assets. Market participants now await whether spot demand will mirror the enthusiasm seen in derivatives markets.

XRP Whales Offload $480 Million in Two Weeks, Signaling Bearish Pressure

XRP faces mounting bearish pressure as large holders accelerate sell-offs. On-chain data reveals whales dumped 160 million tokens ($480 million) since September 4, reducing their collective holdings from 6.95 billion to 6.77 billion XRP. The sell-side activity spans three whale tiers: 1M-10M, 10M-100M, and 100M-1B token holders.

The mid-tier whale cohort (10M-100M XRP) began divesting earlier, slashing positions from 8.1 billion to 7.77 billion since August. Mega-whales (100M-1B XRP) initiated exits in July, though their holdings have stabilized NEAR 7.94 billion after an initial selloff. This distribution pattern suggests waning confidence among XRP's largest stakeholders.

With the token struggling to maintain the $3 psychological level, continued whale selling could trigger cascading liquidations. Market structure now resembles previous capitulation phases where persistent distribution preceded double-digit percentage declines.

XRP ETF Launch Imminent as Market Anticipates $8B Institutional Inflows

The REX-Osprey XRP ETF (XRPR) debuts Friday, marking the first regulated spot exposure to XRP in U.S. traditional finance markets. Analysts project $8 billion in institutional inflows within 12 months, with Franklin Templeton among asset managers expected to follow suit after October decisions.

Technical charts show XRP testing a bull flag breakout from July, with RSI at 52 and MACD maintaining bullish divergence. Regulatory clarity from the SEC has unlocked pent-up demand, creating conditions for parabolic growth—some speculate a $100 price target.

Crypto.com CEO Kris Marszalek's $8B inflow prediction underscores institutional appetite. The ETF launch coincides with XRP's liquidity surge, positioning it as a standout altcoin amid broader market consolidation.

XRP Whales Offload 200 Million Tokens as Price Hovers Near $3

On-chain analyst Ali Martinez sparked market scrutiny this week after revealing that XRP whales dumped approximately 200 million tokens over a two-week period. The transfers, ranging between 160-200 million XRP depending on tracking methodologies, have left traders divided on whether this represents profit-taking or a broader distribution phase.

XRP's price action reflects the uncertainty, consolidating near the $3.00 level with sustained trading volume but no decisive breakout. Technical analysts note that sustained selling pressure could test support at $2.40-$2.80, while a clean break above $3.10-$3.15 resistance WOULD signal renewed bullish conviction.

The whale movements highlight XRP's peculiar position—simultaneously facing distribution from large holders while maintaining liquidity that suggests institutional interest. Market participants are watching whether these transfers represent a local top or merely a liquidity reshuffling before the next leg higher.

Uphold’s Massive 1.59 Billion XRP Holdings Shocks Community, CEO Reveals The Real Owners

Uphold, a cloud-based digital financial service platform, has emerged as one of the largest custodians of XRP after on-chain data revealed it safeguards approximately 1.59 billion tokens. At current market value, the holdings are worth $4.81 billion. CEO Simon McLoughlin clarified that these assets belong entirely to customers, not the exchange itself.

The disclosure sparked surprise across the crypto community, placing Uphold among the top XRP custodians. McLoughlin emphasized Uphold's commitment to "radical transparency," noting the platform maintains reserves exceeding 100% at all times. The CEO highlighted the company's resilience during regulatory turbulence as proof of its trust-based operating model.

Market Experts Reaffirm $1,000 XRP Price Target Amid Institutional Interest

Dom and Phil Kwok, founders of EasyA, have doubled down on their long-term $1,000 price prediction for XRP during a recent appearance on the Thinking Crypto podcast. While acknowledging short-term uncertainty, they emphasized the token's potential for massive institutional inflows once regulatory clarity is achieved.

The resolution of Ripple's SEC lawsuit has removed major barriers for hedge funds and asset managers. "Legal teams are now actively working on compliance frameworks," noted Dom Kwok, suggesting pent-up institutional demand could soon materialize. This aligns with their earlier 2030 projection, though timelines may adjust.

Market observers note XRP's unique position as a bridge asset, with the Kwoks' bullish case resting on anticipated adoption in cross-border payments. The absence of concrete short-term targets reflects ongoing market consolidation, but the $1,000 thesis remains anchored in fundamental utility rather than speculative hype.

Ripple (XRP) Price Predictions for This Week

XRP has reclaimed the $3 level, with buyers successfully defending against seller pressure. The token now faces a critical test at $3.2 resistance—a breakout could signal renewed bullish momentum.

Market activity tells a cautionary tale. Despite the price holding above $3, trading volume continues its months-long decline. This divergence suggests institutional players remain on the sidelines, waiting for clearer signals before committing capital.

The current consolidation phase since July resembles a coiled spring. Such prolonged periods of compression often precede explosive moves. Traders should watch for volume confirmation on any decisive break above resistance or below support.

XRP Price Gains Amid Declining Volume as Market Watches Top Movers

Ripple's XRP edged higher to $3.03 on Wednesday, marking a 1.37% daily increase despite a 19.85% drop in trading volume. Nearly $4.8 billion worth of XRP changed hands as the token extended its weekly gain to 2.24%, pushing its market capitalization to $181.2 billion.

The divergence between price and volume suggests weakening trader interest, typically a cautionary signal for sustained rallies. Meanwhile, MYX Finance, Story, and Aethir led the day's top gainers, while Pump.fun and Ethena topped the losers' board.

Market participants continue weighing how new token listings and security incidents impact valuations. Exchange integrations remain bullish catalysts through liquidity expansion, while hacks triggering forced asset liquidations often create temporary headwinds.

XRP Ledger Developers Propose Confidential Multi-Purpose Tokens to Enhance Privacy

Developers on the XRP Ledger have unveiled a groundbreaking proposal to introduce privacy features to the blockchain's transactions. The new standard, dubbed Confidential Multi-Purpose Tokens (MPTs), aims to allow users to conceal transaction amounts while adhering to token supply rules. The draft, authored by Ripple engineers Murat Cenk and Aanchal Malhotra, was introduced on September 12 via the XRPL Standards forum.

Confidential MPTs represent one of the most ambitious technical upgrades since the XLS-33 standard was implemented earlier this year. The proposal addresses growing demand for privacy among businesses and individuals who find public blockchains overly transparent. Unlike traditional transactions, where balances and movements are visible to all, MPTs would enable confidential transfers without violating issuer or regulatory requirements—particularly critical for assets like Ripple's upcoming stablecoin, RLUSD.

Public blockchains have long traded privacy for transparency, enabling real-time tracking of funds—a feature that aids security but leaves some users exposed. Cenk and Malhotra argue that financial institutions and high-net-worth individuals increasingly seek discretion. "Some see the transparency as too much info to give," they noted, framing the proposal as a middle ground between auditability and confidentiality.

Stablecoins Gain Traction in TradFi Following GENIUS Act Approval

The stablecoin market is making significant inroads into traditional finance, bolstered by the recent enactment of the GENIUS Act under the TRUMP administration. This federal framework provides clarity for institutions and banks on stablecoin issuance, paving the way for broader adoption.

With a current market valuation of $294 billion, stablecoins are poised for exponential growth. Coinbase economists project the sector could reach $1.2 trillion by 2028. Yet, Ripple's Jack McDonald cautions that not all projects meet the necessary standards for interoperability and compliance.

McDonald, who heads Standard Custody & Trust Co. and oversees stablecoins at Ripple, emphasizes that these digital assets must transcend hype. "Stablecoins carry responsibilities of trust, compliance, and scale," he notes, criticizing tokens designed for narrow use cases like gaming or loyalty programs.

XRP Price Prediction: Assessing the Feasibility of a $100 Milestone

XRP's potential to reach $100 has become a focal point of debate in crypto circles. The token, long dominant in cross-border payments, now faces intensified competition, regulatory scrutiny, and market volatility. At its current price of $3.05 with a $181.09 billion market cap, such a target would require unprecedented institutional adoption and market expansion.

Regulatory clarity remains the critical variable. While US legal proceedings have stalled momentum, other jurisdictions are crafting frameworks that could make or break Ripple's ambitions. Emerging projects like Remittix (RTX) demonstrate how quickly the digital payments landscape evolves—threatening XRP's first-mover advantage with faster, cheaper alternatives.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP demonstrates strong potential for significant price appreciation. The combination of technical breakout patterns above key resistance levels and fundamental catalysts including ETF approvals and institutional adoption creates a compelling bullish case.

| Price Target | Timeframe | Probability | Catalysts Required |

|---|---|---|---|

| $5-8 | 3-6 months | High | ETF approval, sustained institutional inflows |

| $15-25 | 12-18 months | Medium | Broader regulatory clarity, mass adoption |

| $50-100 | 2-3 years | Moderate | Global regulatory acceptance, banking integration |

BTCC financial analyst William emphasizes that while the $100 target represents an ambitious long-term prospect, the current market structure and institutional interest provide a realistic foundation for sustained upward movement, particularly if ETF inflows materialize as anticipated.